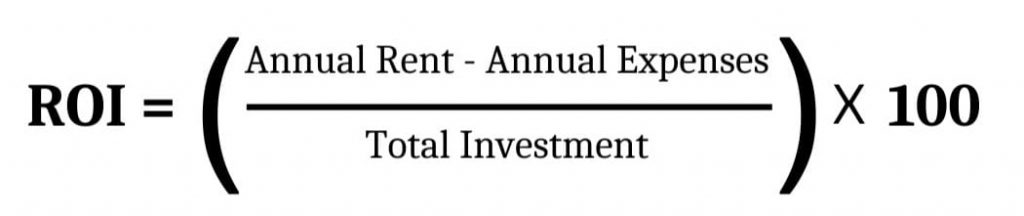

To calculate the return on investment (ROI) for a rental property, you can use the following formula:

Here’s an example of how to use this formula:

Let’s say you bought a rental property for $200,000 and your annual expenses (mortgage payments, property taxes, insurance, and maintenance) total $20,000. The annual rent you charge is $30,000. Using the formula above, the ROI for this property would be:

ROI = ($30,000 – $20,000) / $200,000 x 100 = 10%

This means that your return on investment for this property is 10%.

It’s important to note that this is just one way to calculate the ROI / Return on investment for a rental property. There are other factors that can impact the profitability of a rental property (such as the local real estate market, the condition of the property, and the demand for rental properties in the area). Additionally, this calculation does not take into account the time value of money, which means it does not account for the fact that money is worth more today than it will be in the future due to inflation.

If you want to take a more detailed approach to calculating the ROI for a rental property, you may want to consider using a financial calculator or software that takes into account a wider range of factors, such as the time value of money and the potential for appreciation or depreciation of the property over time.